Gaining a clear picture of your net worth is a simple exercise.

Assets

Add up all of your assets first. Assets include, but are not limited to, the following:

- Checking/saving accounts

- Health savings accounts

- Investments such as stocks, mutual funds, 401Ks, IRAs, etc..

- Physical assets such as a house, condominium, car, etc.

- Cash

Once you finish pulling together the value of your assets, add together all your liabilities. Liabilities include, but are not limited to, the following:

- Credit card balances

- Mortgage

- Student loans

- Car loan

- Any other loans

Example

Let’s look at an example to demonstrate:

Assets

- Personal Checking Account: $5K

- Investments: $100K

- Car: $20K

- Condo: $300K

Total Assets: $425K

Liabilities

- Credit card balance: $1K

- Mortgage on condo: $200K

- Car Loan: $15K

Total Liabilities: $216K

Net Worth

- Assets – Liabilities = Net Worth

- $425K – $216K = $209K

In this example, the net worth is $209K, not a shabby number to have!

Are there any sites that I can use to track my net worth?

To track your net worth, there are several options. I personally use a spreadsheet, such as Microsoft Excel or Google Docs, to track my net worth.

Several investment and banking web sites, like Fidelity.com, give you the ability to track your net worth as well. Alternatively, sites like Mint.com make it easy to track your net worth too.

What should I make of my number?

Don’t be discouraged if your net worth is negative or very low after working through this exercise. Having a negative net worth isn’t necessarily a bad thing. For example, if you’re in school, you’ll likely have a heavy student debt load and the debt will most likely exceed your assets. However, one of your greatest assets is you and your ability to earn over your career. Your earning ability will assist you to claw out of the debt and to start building up substantial net worth.

If, however, you have been working for a few years and your net worth is uncomfortably low, you'll need to seriously sit down and to evaluate your financial situation to put it on the right path.

Repeat this exercise periodically to track your progress

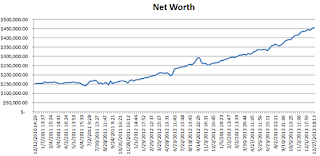

Over your career, you should repeat this exercise often to track that you’re heading in the right direction. If your net worth is heading up, it means that you’re budgeting appropriately, that your costs are under control, and that you’re making good decisions with how you spend your money. Ideally, your net worth over time should look something like this example:

Myths about net worth

- A higher salary doesn’t necessarily equate to a greater net worth. Someone with a higher salary may simply spend more of his or her money.

- A negative net worth isn’t necessarily a bad thing as long as the direction is up over the long-term. For example, when you’re in school, your net worth will be small, but you’re investing in yourself, which will ultimately help you build your net worth.