|

| Find out how to invest $81K a year, with much of it sheltered from taxes |

Every year when I file my taxes, I’m reminded about how much

of my income goes towards running the government. A little over 25% of my total

income goes towards income taxes, social security taxes, Medicare, and other

programs.

Over time, I’ve picked up several strategies that have

allowed me to amass a large net worth while either paying no taxes on my gains

or only paying taxes when I finally withdraw my investments.

Looking back, I wish someone had told me about all of these

strategies when I first started working so I could have implemented them earlier.

I wanted to share these 5 steps that

I’ve learned so you too can take advantage of these strategies. If there are

any others that you know, please share them in the comments.

As a note, I wrote this short guide for people who work for

companies and have access to programs like a 401K. Even if you don’t work for a

company, this content can still be relevant. For instance, if you work for the

government, you’ll have access to a Thrift Savings Plan, which is equivalent to

a 401K. Additionally, this article is for people who live and work in the

United States.

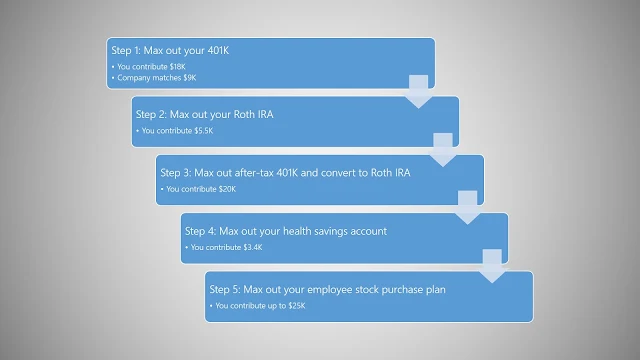

Step 1: Max out your 401K

As a first step, you should absolutely max out your 401K.

You can contribute up to $18K/year and you should contribute the full amount.

The company I work for is quite generous and they match 50% of your

contributions and vesting is immediate. This serves as an incentive to max out my

contribution. The earlier I max out in the year, the sooner I have access to

the $9K matching. I contribute all of the money pre-tax, so I only pay taxes

when I eventually withdraw the money.

- Amount invested: $27K (includes $9K matching)

- Total invested: $27K

Step 2: Max out your Roth IRA

If you make less than $116K, you can contribute $5.5K directly

into a Roth IRA. You pay taxes up front and you never have to pay taxes again

on any of the growth. If you make more than $116K, you can contribute $5.5K to

a traditional IRA and then convert it into a Roth IRA. It’s a backdoor way to

skirt around the income restrictions allowing you to still contribute the full

amount to your Roth IRA.

- Amount invested: $5.5K

- Total invested: $27K + $5.5K = $32.5K

Step 3: Max out your after-tax 401K and convert to a Roth-IRA

Once you’ve maxed out your Roth IRA, contribute $20K to your

401K after-tax. Once you max this out, roll it over to your Roth IRA. This

allows you to funnel another $20K into a Roth IRA. Once in a Roth IRA, you

never have to pay taxes on any of the gains.

- Amount invested: $20K

- Total invested: $27K + $5.5K + $20K = $52.5K

Step 4: Max out your health savings account (HSA)

Once you max out your after-tax 401K contributions,

contribute $3.4K to your health savings account. This is untaxed money that you

can use towards healthcare expenses. Once you’re in your 60s, you can use this

for healthcare, or anything else. If you decide to use the money for

non-healthcare expenses, it’s just like a traditional IRA where you pay taxes

on it when you withdraw.

- Amount invested: $3.4K

- Total invested: $27K + $5.5K + $20K + $3.4K = $55.9K

Step 5: Max out your employee stock purchase plan (ESPP)

Many companies offer employees a stock purchase plan. This

allows you to save another $25K or 15% of your income, and depending on the

company, you’ll get an instant discount on company stock. My company offers a

10% discount on stock. I typically sell the company stock immediately after the

offering period and invest it elsewhere. You can read this article

on the merits of investing in an ESPP. Although an ESPP is not protected from

taxes, the discount on stock is an immediate return.

- Amount invested: $25K

- Total invested: $27K + $5.5K + $20K + $3.4K + $25K = $80.9K

You’re all set

If you take advantage of all of these strategies, your net

worth will skyrocket in no time. Now that you know what accounts to put your

money into, where should you invest it?