|

| A market timing strategy that even a monkey can do |

The difficulty of

timing the market

In the last 13 years alone, we’ve experienced two crashes,

one caused by the dot com bubble bursting in 2001 and another caused by the

sub-prime housing crisis in 2008. Selling immediately before these crashes and

then repurchasing your investments at the trough would have been extremely

profitable. Yet, timing the rise and

fall is close to impossible. Several analysts predicted for years that the

sub-prime mortgage industry would collapse and yet prices continued to rise despite the dire predictions. No one was able to predict when the fateful fall

would actually happen.

Well then, when

should I invest my money?

The secret to investing in the market is to invest right now,

always. Whether you have a lump sum or only a little bit of cash, you should invest right away if you have

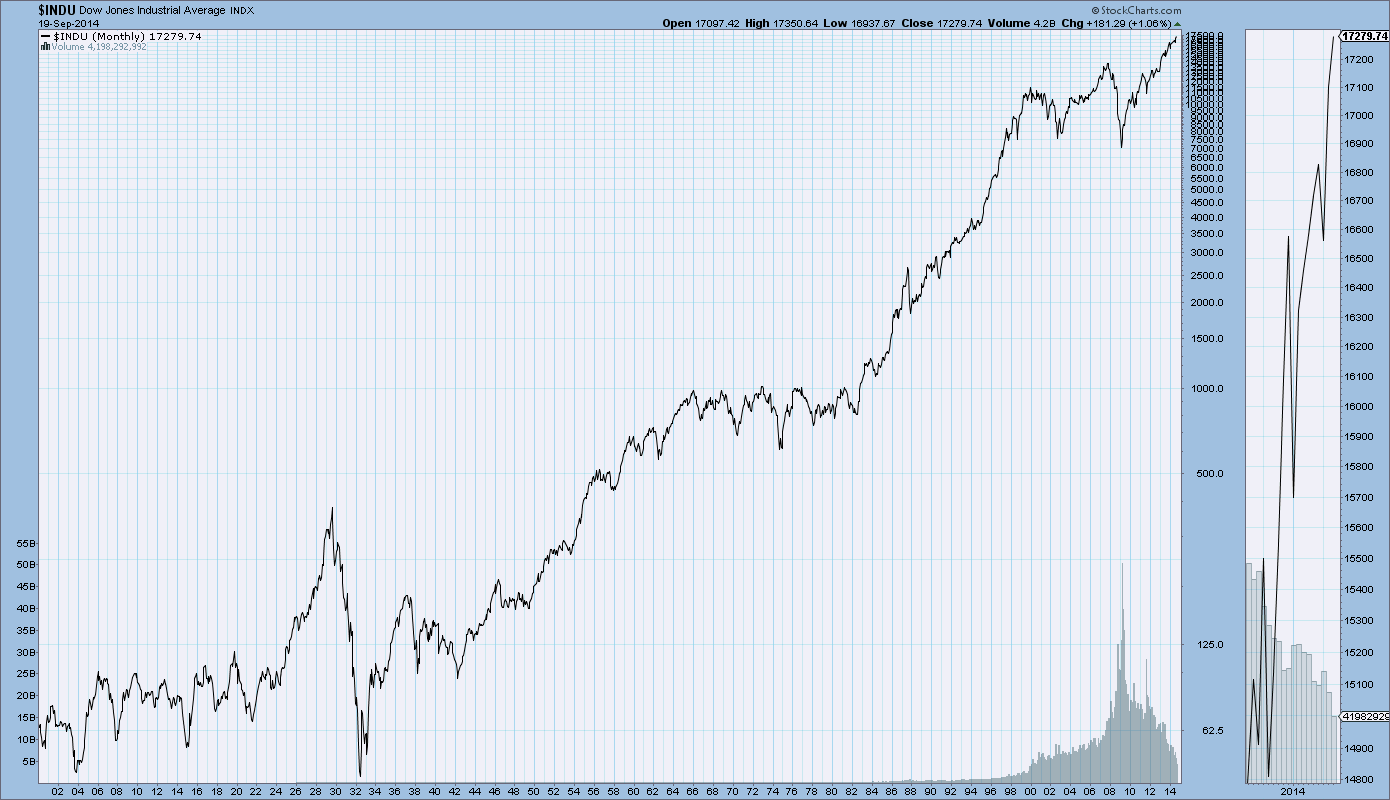

money on hand. Over the long-term, the market has

always increased in value. In the chart below, you can see the performance of

the Dow Jones Industrial Average over 114 years from 1900 through the present day (9/21/2014).

|

| Dow Jones Industrial Average performance from 1900 to 2014 from stockcharts.com |

There are high points and very low points over the years in the market, but the

direction has always been up over the long-term (or an approximately 10% compound

annual growth rate per year). Even if you invested money immediately before the

Great Depression in October 1929 or during the Great Depression, today you would still be far

ahead of where you started. Given that over the long-term the market goes up, you

tend to be better off investing today than you are investing tomorrow.

Not sure where to invest? Read the post on deciding where to invest your 401k.

Not sure where to invest? Read the post on deciding where to invest your 401k.